Payroll management is one of the most time-sensitive and regulated aspects of running a UK business. That’s why many companies turn to professional accountants to assist with payroll processing, ensuring compliance with HMRC rules and freeing up valuable time.

Payroll deadlines in the UK often fall on the 27th, making this one of the most stressful days of the month for business owners. Errors, missed deadlines, and non-compliance with HMRC rules can lead to fines and unhappy employees.

At Force Accounting, we help UK businesses simplify payroll, stay compliant, and ensure every employee is paid accurately and on time.

This guide explains how accountants assist with payroll in the UK, covering compliance, tax efficiency, and employee benefits — and why outsourcing may be the smarter choice in 2025.

Why Outsource Payroll in the UK?

✅ Accuracy — avoid costly payroll errors.

✅ Compliance — stay aligned with HMRC rules.

✅ Cost savings — reduce the need for in-house staff.

✅ Efficiency — payroll delivered on time, every time.

✅ Growth support — scalable services as your workforce expands.

Outsourcing payroll ensures businesses can focus on growth while accountants manage the details.

📞 Need expert payroll support? Speak to a Force Accounting advisor today for tailored advice on payroll compliance and accuracy.

How Accountants Assist with Payroll

1. Accurate Payroll Calculations

Accountants ensure:

Correct calculation of gross pay, NICs, tax, pensions, student loans, and other deductions.

Adjustments for bonuses, overtime, commissions, and statutory pay.

Smooth management of part-time, freelance, or contract workers.

2. Compliance with HMRC Regulations

Payroll compliance in 2025 involves:

Submitting Real-Time Information (RTI) reports to HMRC.

Ensuring PAYE deductions are accurate.

Meeting National Minimum Wage requirements (updated April 2025).

Keeping up with auto-enrolment rules and changes in employment law.

Not sure if your payroll meets the latest HMRC requirements? Get free accounting advice from a Force Accounting payroll specialist.

3. Managing Pensions and Auto-Enrolment

Accountants:

Enrol eligible staff into workplace pensions.

Manage contributions and opt-outs.

Handle re-enrolment cycles and communication with The Pensions Regulator.

4. Tax Efficiency and Advice

Payroll isn’t just admin — it’s financial strategy. Accountants advise on:

Salary sacrifice schemes (pensions, childcare, cycle-to-work).

Tax-efficient benefits like company cars or healthcare.

Making use of allowances and reliefs to reduce costs.

5. Employee Benefits Management

Accountants:

Report benefits in kind (P11D).

Calculate deductions for perks such as gym memberships or share options.

Manage benefits compliance to avoid unexpected tax bills.

6. Payroll Record Keeping

Businesses must keep payroll records for at least 3 years. UK payroll services:

Maintain organised, accurate records.

Ensure payslips meet UK legal requirements.

Provide documentation for HMRC audits.

7. Handling Payroll Software

Accountants:

Recommend and set up payroll software.

Train staff on usage.

Integrate payroll with other financial systems.

Ensure updates for new tax rules are applied.

8. Assisting with Audits and Inspections

If HMRC audits your business, accountants:

Provide records and reports.

Ensure compliance.

Represent your business during inspections, reducing risk of fines.

9. Support for Business Growth

As your business scales:

Accountants adapt payroll services for new hires and structures.

Offer advice on payroll planning to control costs.

Provide insight into long-term payroll strategies.

In-House Payroll vs Outsourced Payroll (Comparison)

Feature | In-House Payroll | Outsourced Payroll with Accountants |

|---|---|---|

Accuracy | Dependent on internal staff skills | Expert-managed, reduces errors |

Compliance | Risk of missing HMRC updates | Always aligned with latest rules |

Cost | Salary + software costs | Typically lower, scalable |

Efficiency | Time-consuming for staff | Faster, frees up internal resources |

Growth | Limited capacity | Scales easily with business size |

Benefits of Outsourcing Payroll Services

Professional accountants not only ensure accuracy in your payroll processing but also assist with payroll compliance, ensuring that you avoid costly mistakes and penalties. Their expertise in managing deductions, pension schemes, and HMRC submissions helps businesses stay compliant, no matter how complex their payroll needs may be.

Here are some key benefits of UK payroll services:

Full compliance with HMRC regulations.

Reduced admin burden.

Scalable services as your business grows.

Expert handling of pensions, benefits, and payroll records.

Cost savings compared to hiring in-house staff.

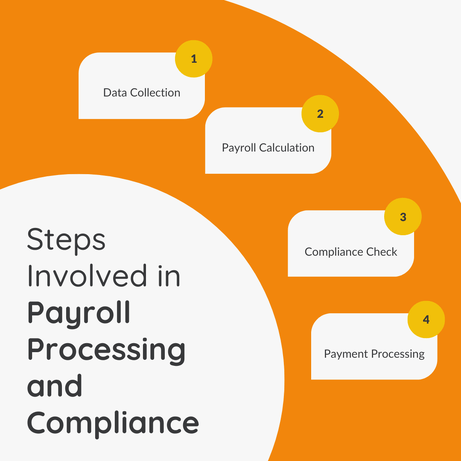

Steps Involved in Payroll Processing and Compliance

The process of payroll processing and compliance involves several steps:

Data Collection: Gathering employee data, including hours worked, salaries, and any deductions.

Payroll Calculation: Calculating net pay, taxes, and other deductions.

Compliance Check: Ensuring all payments are compliant with UK regulations.

Payment Processing: Processing payments to employees and relevant authorities.

How Accountants Can Assist with Payroll Processing and Compliance.

Accountants can assist with payroll by managing the day-to-day processes involved in payroll administration, from calculating salaries to processing tax withholdings. They can also provide valuable insight into making your payroll system more efficient, helping you streamline workflows and stay up-to-date with the latest tax regulations and reporting requirements.

Payroll Services for UK Businesses

At Force Accounting, we understand the complexities and time-consuming nature of payroll processing and compliance, which is why we offer comprehensive payroll services tailored specifically for UK businesses.

Our experienced team of accountants is dedicated to ensuring that your payroll service is efficient, accurate, and timely, allowing you to focus on the core aspects of your business.

We handle all facets of payroll management, including:

Accurate payroll calculations, such as gross pay

National Insurance Contributions (NICs)

Tax

Pensions

And other deductions like student loans or court orders.

Our experts are well-versed in managing varying pay structures, including those for part-time, freelance, or contract workers, and can account for complexities like bonuses, commissions, overtime, and statutory pay.

Our payroll services also ensure compliance with HMRC regulations, including

The submission of Real-Time Information (RTI) reports,

Adherence to PAYE (Pay As You Earn) regulations

And compliance with the National Minimum Wage and auto-enrolment pension rules.

We maintain accurate and organised payroll records, produce payslips, and ensure all necessary documentation is available for HMRC inspections or audits.

By outsourcing your payroll to Force Accounting, you gain the confidence that your company’s payroll will be run accurately and delivered on time, every time. Our dedicated account managers and CIPP-accredited experts are always available to provide support, ensuring a hassle-free experience.

With our bespoke payroll solutions, you can trust that your payroll needs are in capable hands, allowing you to concentrate on what matters most – growing your business.

Get in touch today to discuss how we can support your business’s payroll needs!

FAQs: Payroll Services UK

What does an accountant do for payroll in the UK?

They manage payroll calculations, HMRC submissions, pensions, benefits, and ensure compliance.

Is it cheaper to outsource payroll in the UK?

For most small to medium businesses, yes — outsourcing reduces the need for in-house payroll staff and costly software.

How do small businesses manage payroll?

Many use accountants to handle payroll processing, tax, pensions, and RTI submissions, saving time and reducing mistakes.

What happens if payroll is not compliant with HMRC?

Businesses face fines, penalties, and potential reputational damage. Accountants ensure compliance to avoid this risk.

Get Personalised Payroll Advice

Ensure your payroll is accurate, compliant, and efficient.

Speak to Force Accounting’s payroll experts for free professional advice today.

Final Words

Accountants play a critical role in assisting with payroll processing and compliance in the UK. From accurate calculations to strategic tax advice, outsourcing payroll ensures businesses remain compliant, efficient, and focused on growth in 2025.

Contact Us Today

If you're looking to streamline your payroll processing and ensure full compliance with UK regulations, it's time to partner with a professional accountant. Avoid costly mistakes, save valuable time, and focus on growing your business while we handle the complexities of payroll.

We are trusted by UK SMEs across retail, tech, and professional services.

Get in touch today to discuss how we can assist with payroll.

In addition to UK payroll services, our accountants can also assist with Bookkeeping services.